Houston Rental Market Update: What 2025 Taught Us and How Smart Landlords Win in 2026

2025 is officially in the books. What a year.

As we head into 2026, this is a good moment to zoom out, look at what actually happened, and talk about what disciplined rental investors should be doing next.

The short version:

Ignore the hype. Focus on fundamentals. Optimize for occupancy, durability, and long-term returns.

Boring still wins.

Block Out the Noise and Play the Long Game

There will always be a trend or a “hot” market being sold by influencers.

Airbnb.

Austin.

Whatever is next.

The reality is that long-term rentals, held for many years, dramatically outperform chasing the next shiny thing. Time in the market beats timing the market. Compounding beats cleverness.

When it comes to investing, boring wins.

Do a Real Portfolio Review

Before making any big moves in 2026, complete a real review of your portfolio.

Ask yourself:

What actually performed in 2025?

Did CapEx show up early?

Do you have deferred expenses coming for roofs or HVAC?

Are you setting aside enough reserves, or are you one expensive turn away from a bad month?

Don’t be the owner who gets wiped out by a single repair.

Be harder to kill.

Do Your Properties Still Serve Your Goals?

Your priorities may have shifted. A rental that made sense five years ago may not serve your goals today.

If that is the case, think clearly about what you would move that capital into.

Be careful not to fall into “the grass is always greener” thinking. Jumping to the next thing before the current investment has had time to compound is one of the most common long-term investor mistakes.

If you are considering selling any real estate investment, here are three things to keep in mind:

This is not the best environment to be a seller. With high inventory, buyers have leverage

Transaction costs are high. Commissions, taxes, depreciation recapture, and friction add up fast

Understand the performance and volatility of whatever you plan to move your money into

For our owner clients, we handle sales analysis, CapEx projections, and portfolio performance tracking through our Quarterly Business Reviews and Annual Executive Strategy Reviews.

Either way, 2026 is a year to block out the noise and stay ruthlessly focused on your goals.

Total Portfolio Performance at a Glance

Rent Collection Rate: 97.7% (vs. 92.6% Houston average)

Eviction Rate: 1.6% (vs. ~9% Houston average)

Occupancy Rate: 91.2% (vs. 90.8% Houston average)

These are strong numbers across the board.

Traditionally, we see a noticeable spike in evictions during the holiday season. This year, the increase was mild and well within normal operating ranges.

A big part of this performance comes from Liz, our dedicated in-house Leasing Agent. Leasing during Q4 is one of the most difficult environments of the year, and her execution over the holidays materially improved both rent collection and occupancy.

Quick Tip: Avoid ending leases in Q4 (October, November, or December). Leasing during this window usually means longer days on market and softer tenant demand.

Houston Market Snapshot

Houston rental inventory continues to see double-digit growth.

New Listings (HAR): 4,525 → 5,486 (+21.2% YoY)

Average Rent: $2,263 → $2,245 (–0.8% YoY)

Average Days on Market: HAR – 48 days | Emerson – 46 days (4.2% faster)

There is no real surprise here.

Inventory is up.

Rents are flat.

And we are still leasing faster than the broader market, even if slower than I would prefer.

I started writing about this trend back in June 2025, and it has played out almost exactly as expected.

Landlords will continue to face pressure until one of two things happens:

Inventory comes down

Demand increases meaningfully

Demand has been steady, which is the good news. The headwind is supply.

Sellers who cannot sell their homes are turning into landlords, which keeps pushing rental inventory higher and increasing competition.

As I have said for the past six months, stay the course and build slightly larger reserves.

These are the environments where disciplined investors quietly win.

This is not the time to panic or pivot.

This is the time to be patient, liquid, and selective.

Maintenance Update

Median Speed of Repair: 5.4 days (vs. ~6–7 days national average)

Resident Satisfaction: 4.7 / 5.0

Work Orders Cancelled: 19.5%

Maintenance performance continues to be a major strength.

December is traditionally one of the slowest months for repairs due to holidays, contractor availability, and weather-related delays. Despite that, our median speed of repair still beat the national average.

Resident satisfaction remains exceptionally high. Very few property management companies nationally maintain a score above 4.2. Sustaining a 4.7 out of 5.0, while canceling nearly 20% of all work orders, is a strong signal that issues are being resolved correctly the first time and that unnecessary or duplicate work is being filtered out.

This score is one of the primary ways we evaluate and manage our vendors.

After every maintenance request, residents receive a short survey where they rate the vendor from 1 to 5 and can leave feedback. This allows us to hold vendors accountable not just on price, but on responsiveness, professionalism, and resident experience.

This feedback loop is how we keep maintenance fast, fairly priced, and high quality.

Quick Tip: If you are self-managing, text your residents after each maintenance request and ask how the vendor performed. Patterns show up fast.

Owner and Resident Satisfaction

Owner Retention Rate: 99.2%

Lease Renewal Rate: 64.5% (vs. ~55–65% national average)

Owner retention continues to rank among top national performers. In practical terms, our owners rarely leave. That is the clearest long-term signal that our service model and execution are working.

Lease renewals dipped this month to the high end of the national average. Historically, we run closer to 75–80%, so this is an area we are actively focused on improving.

The most common reasons cited were work relocations and family-related life changes, not dissatisfaction.

We are increasing proactive renewal conversations, being more available and responsive, and introducing more flexibility around renewal timing and terms to reduce unnecessary move-outs.

Keeping good residents in place is one of the highest-ROI things you can do as a rental owner.

Quick Tip: Remove as many barriers to renewal as possible. Do not give residents a reason to leave over friction, fees, or slow responses.

Value-Add Spotlight

While most properties are leasing at or below last year’s rent, 5807 Burlinghall Drive leased 13.2% higher than its previous rate.

We completed a simple turnover totaling $2,723, which included:

Targeted exterior repairs to improve curb appeal

Our standard preventative maintenance protocol

General painting and professional cleaning

The result:

Rent increased from $2,142/month to $2,425/month

A $283/month increase, or 13.2%

Leased in 24 days, during December

Even in a market where rents are flat or declining, there are still micro-markets and individual properties where rent can be pushed strategically.

The difference is knowing where and how far to push without blowing up vacancy.

A big part of this outcome comes from Liz, our dedicated in-house Leasing Agent. She has leased thousands of properties across Houston and brings real-time market feedback into our pricing and positioning strategy.

This is what professional asset management actually looks like.

Owner Insight of the Month: Vacancy Kills Cash Flow

As more competition enters the market, it is tempting to hold firm at last year’s rent price. That is usually a bad strategy.

One extra month vacant on a $2,400/month rental does not just cost you $2,400.

It costs you roughly $200 per month for the entire year once you annualize the loss. And when you factor in utilities, lawn care, HOA, insurance, and property taxes, you are often losing $80–$120 per day while the property sits empty.

That is real money.

The formula for minimizing vacancy is simple:

Complete a thorough, high-quality make-ready

Take professional photos

Price the property appropriately relative to competition

Respond quickly to prospective residents

Adjust pricing based on lead volume

Miss any one of those and vacancy explodes.

If you get to the end of the year wondering why your rental underperformed, start by checking your occupancy.

The market always tells you the truth.

Your job is to listen before vacancy makes the point for it.

Final Thoughts

2026 is not the year to panic or pivot.

It is the year to block out the noise, build durability into your portfolio, and stay ruthlessly focused on fundamentals.

If you want help reviewing your portfolio, projecting CapEx, or stress-testing your cash flow, that is exactly what we do at Emerson.

To your success,

Cam

16 Days vs 43: How We’re Leasing Faster in Houston Right Now

The Houston rental market continues to shift as elevated inventory, flat rent growth, and increased competition put more pressure on execution. In environments like this, outcomes are less about optimism and more about disciplined operations.

Below is a snapshot of how our managed portfolio is performing alongside the broader Houston market, followed by practical insights for property owners navigating the months ahead.

Portfolio Performance at a Glance

Despite challenging market conditions, our portfolio continues to outperform key benchmarks.

Rent Collection Rate: 97.8%

Houston Average: 92.6%

Strong rent collection supports consistent cash flow and reduces the need for legal action or owner intervention.

Eviction Rate: 0.39%

Houston Average: ~9%

Lower eviction rates help limit vacancy, legal costs, and property damage, preserving long-term returns.

Occupancy Rate: 89.6%

Houston Average: 90.8%

Occupancy remains slightly below the market average, driven largely by intentional lease timing and rent discipline rather than reactive price reductions. Strategic vacancy management during winter months often protects long-term value.

Houston Market Snapshot

Houston rental inventory remains elevated compared to last year, increasing competition among available properties.

New Listings (HAR):

5,102 → 5,876 (+15.2% year over year)

Average Rent:

$2,235 → $2,244 (+0.4% year over year)

Average Days on Market:

Houston Average: 43 days

Our Portfolio: 16 days (62.8% faster)

Listings are up while rent growth remains flat. In this environment, pricing accuracy, marketing execution, and leasing speed matter more than ever. Leasing performance is no longer forgiving of delays or missteps.

Maintenance Performance Update

Operational efficiency continues to be a key differentiator.

Median Speed of Repair: 3.5 days

National Average: ~6–7 days

Faster repairs reduce resident disruption and help prevent secondary property damage.

Resident Satisfaction: 4.2 / 5.0

Overall satisfaction remains strong. Minor dips were largely driven by appliance-related repairs, which tend to carry higher friction due to parts availability and resident expectations.

Work Orders Cancelled: 15.9%

Cancellations typically reflect early issue resolution, duplicate submissions, or clarified resident requests rather than delayed service.

Owner Insight: Appliances remain one of the highest-cost and highest-friction components of rental housing. Where market conditions allow, limiting owner-provided appliances can reduce long-term repair costs. When appliances are necessary, proactive replacement planning often outperforms reactive repairs.

Owner and Resident Stability

Stability continues to be a strength of the portfolio.

Owner Retention Rate: 99.1%

Lease Renewal Rate: 78%

National Average Renewal Rate: ~55–65%

Higher renewal rates reduce vacancy exposure, leasing costs, and turnover risk. In a competitive market, renewals are one of the most effective levers for protecting cash flow and maintaining consistency.

Our focus going forward remains proactive renewal strategies that help owners minimize disruption during periods of elevated competition.

Value-Add Spotlight

809 Irish Maple St.

This property joined our portfolio last year at $2,950 per month. After a targeted $3,400 turn, the home leased in just six days at $3,249 per month.

Results:

+$299 per month in rent

+$3,588 annually

Turn cost recovered in under 12 months

Strategic improvements, combined with disciplined pricing and strong leasing execution, often deliver meaningful rent gains without over-improving the property.

Owner Insight of the Month

Markets like this reward preparation more than prediction.

Rather than relying on appreciation or rent growth to offset inefficiencies, successful property owners focus on what they can control: cash reserves, lease timing, realistic pricing, and minimizing unnecessary turnover.

Real estate continues to favor owners who can hold through slower periods without being forced into rushed decisions. Preserving flexibility today often creates the best opportunities tomorrow.

Thinking About Your Own Property?

Many owners reach out to us when they start asking:

Is my rent positioned correctly for today’s market?

Should I renew or re-lease this property?

Where am I exposed if conditions tighten further?

If you are evaluating your strategy for the year ahead, a thoughtful review now can prevent expensive decisions later.

Final Thoughts

The Houston rental market is competitive, evolving, and full of both challenges and opportunities. Whether it’s keeping properties rent-ready, troubleshooting maintenance to save money, or holding through a rebalancing housing cycle, the fundamentals remain the same:

👉 Protect your cash flow, manage vacancies aggressively, and look for hidden value in your current portfolio.

👉 Want insights like this delivered straight to your inbox each month? Sign up for our free Houston Rental Market Newsletter.

Freeze Season Is Here: Protect Your Cash Flow

Houston’s rental market continues to shift, and staying informed is the easiest way to protect your cash flow. Below is a straightforward breakdown of how the market is moving, how Emerson performed this month, and what smart investors should be watching.

Portfolio Performance Overview

We snapped back to outperforming the Houston market across every major metric this month:

Rent Collection Rate: 96.5 percent

Houston average: 92.6 percentEviction Rate: 0.8 percent

Houston average: about 9 percentOccupancy Rate: 94.7 percent

Houston average: 90.8 percent

After a few months of cleaning up tough evictions and getting hard-to-lease homes across the finish line, our numbers strengthened heading into year-end.

Quick Tip: Avoid ending leases in October, November, or December unless there’s a strategic reason. Winter vacancies drag out, cost more, and can erase gains from an otherwise solid year.

Houston Market Snapshot

Inventory continues climbing to record levels, which is keeping rent growth muted:

New Listings (HAR): 5,935 to 7,122 (+20.0 percent YoY)

Average Rent: $2,251 to $2,262 (+0.5 percent YoY)

Average Days on Market (DOM):

HAR: 39 days

Emerson: 36 days (32.4 percent faster)

If you’ve been following along, this theme won’t surprise you. More inventory means more competition and less pricing power. The good news: you don’t need fancy strategies. You need fundamentals:

Strong make-readies

Tight screening

Realistic pricing

Adequate reserves

These alone separate professional operators from hobbyists who will inevitably pivot to their next shiny object, probably some crypto MLM hybrid.

We did have a handful of homes with longer DOM, mostly in fringe or lower-demand areas such as Freeport. These properties finally leased, which raised our monthly average slightly.

Investor Note: This is not a forgiving acquisition market. Buy with long-term desirability in mind. Cash flow projections only matter if the home stays rented.

Maintenance Update

Median Speed of Repair: 6.1 days

National average: about 6 to 7 daysResident Satisfaction: 4.4 out of 5.0

Cancelled Work Orders: 21.8 percent

A few large repairs bumped timelines up, but not because of operational delays. Resident satisfaction remains strong, and we continue to cancel one in five work orders, usually because the issue is resident-caused or solved through troubleshooting.

Our goal is simple: protect your maintenance budget while delivering a resident experience that improves renewals and reduces turnover. Both directly shape your long-term returns.

Owner and Resident Satisfaction

Owner Retention: 99.5 percent

Lease Renewal Rate: 38 percent

National benchmark: 55 to 65 percent

Owner retention increased again as we finalized a few strategic off-boardings and completed several sales.

The metric we’re watching closely is our renewal rate. Historically we’ve been near 80 percent, so the recent dip stands out. Most non-renewals are tied to life events like relocations or family changes, not operational issues. I’ll share a deeper analysis in the annual letter, but improving this number is a top priority.

Value-Add Spotlight

A recent turnover at 3208 Windchase Blvd totaled $3,407 and included:

Repairs

Deferred and preventative maintenance

Painting

Cleaning

The result: a $75 monthly rent increase (five percent), taking it from $1,500 to $1,575, and it leased in 23 days.

In a flat or declining rent environment, strategic upgrades and property condition still move the needle. Quality homes command quality rent.

Owner Insight of the Month: Freeze Damage Prevention

Even a short Houston freeze can burst pipes and create thousands in damage. Most losses come from simple, preventable oversights:

Hose bibs not covered

Heat not left on

Exposed pipes unwrapped

Utilities turned off

Water left on at vacant homes

Key Points to Know:

Freeze damage is almost always an owner expense

Insurance can deny claims if utilities weren’t active or basic prep wasn’t done

One freeze event can wipe out years of cash flow

Here’s what we’re doing:

We’ve already sent winterization instructions to residents and prepped our emergency vendors. Once freeze dates are announced, we’ll notify residents, audit vulnerable homes, and conduct vacant property checks to ensure utilities are on and water is off.

Your action:

If you have properties outside of our management, shut the water off at any vacant home. This alone prevents most catastrophic losses.

Final Thoughts

The Houston rental market is competitive, evolving, and full of both challenges and opportunities. Whether it’s keeping properties rent-ready, troubleshooting maintenance to save money, or holding through a rebalancing housing cycle, the fundamentals remain the same:

👉 Protect your cash flow, manage vacancies aggressively, and look for hidden value in your current portfolio.

👉 Want insights like this delivered straight to your inbox each month? Sign up for our free Houston Rental Market Newsletter.

Why Flat Rents Could Be Great News for Savvy Landlords

The Houston rental market continues to level off, and while some numbers have softened, the fundamentals remain strong for disciplined owners. Below is a snapshot of what’s happening across our portfolio, and what it means for you as a property owner or investor.

📊 Total Portfolio Performance at a Glance

Rent Collection Rate: 89.4% (vs. 92.6% Houston average)

Eviction Rate: 1.6% (vs. ~9% Houston average)

Occupancy Rate: 93.1% (vs. 90.8% Houston average)

Rent collection dipped below 90% for the first time since we began tracking this data, largely due to a recent spike in evictions. In the past six months, we’ve had more evictions than in the previous twelve combined.

We’re currently reviewing changes to Texas eviction laws to identify ways to expedite the process and completing our annual analysis to update our screening criteria. On a brighter note, occupancy has rebounded from August thanks to strong lease-ups on new onboarded and previously challenging properties.

Takeaway: Even with strong qualifications, evictions can still happen. Screening reduces the odds — but never to zero. That’s why we offer our Eviction Guarantee to protect owners against unexpected losses. If your management company doesn’t offer one, ask why.

📈 Houston Market Snapshot

New Listings (HAR): 5,510 → 6,841 (+24.2% YoY)

Average Rent: $2,341 → $2,347 (Flat YoY)

Average Days on Market: HAR – 37 days | Emerson – 25 days (32.4% faster)

Inventory remains elevated and rents have stayed flat for most of the year, a clear sign that tenants now have more choices and more leverage.

That’s why we continue emphasizing our Rent Ready Requirements. Properties that are clean, well-maintained, and truly move-in ready lease faster and attract better tenants. In today’s high-supply market, presentation is everything.

Takeaway: In a crowded market, the best-presented homes win. Investing a little more upfront in condition and curb appeal leads to faster leasing and stronger residents. You only get one first impression, make it count.

🛠️ Maintenance Update

Median Speed of Repair: 3.9 days (vs. national avg. 6–7 days)

Resident Satisfaction: 4.5 / 5.0

Work Orders Cancelled: 25.6%

Our repair times continue to outperform industry averages, even against companies with in-house maintenance teams, which drives consistently high resident satisfaction.

About one in four work orders last month were cancelled because they were cosmetic or a resident responsibility. Striking the right balance between denying unnecessary requests and keeping residents satisfied is key to preventing turnover.

Takeaway: Fast repairs build trust, but setting clear expectations is just as important. The best operators fix what matters quickly and help residents understand what doesn’t.

💬 Owner & Resident Satisfaction

Owner Retention Rate: 97.2%

Lease Renewal Rate: 67% (vs. 55–65% national avg.)

Owner retention dipped slightly as a few owners chose to sell. If you’re considering the same, waiting until spring for stronger buyer activity, or ideally 2–4 years for inventory to normalize, may produce a better outcome.

Renewals remain above the national average but below our typical 75–80%. Most move-outs were due to lifestyle changes rather than property condition. Interestingly, two residents cited maintenance concerns despite having almost no service history, proof that perception and communication are just as important as actual performance.

Takeaway: In a flat rent market, renewals are your best ROI lever. Focus on resident experience, proactive communication, and small improvements that make tenants want to stay.

📸 Cautionary Spotlight: The Rent Growth Reality Check

When evaluating a rental property, most investors assume 3–5% annual rent growth, a rule of thumb that’s held true for years. But the market is shifting. Many new leases are now flat or slightly below prior rates:

$2,855 → $2,695

$2,040 → $1,875

$1,805 → $1,849

This isn’t cause for concern, it’s a natural reset after a decade of rapid appreciation. We expect rent growth to remain modest for the next couple of years before returning to historical averages.

The best investors see this as an opportunity. As “hobby landlords” panic and sell, disciplined owners who maintain standards and hold capital will be positioned to buy strong assets below market value.

Takeaway: Flat rent growth isn’t a threat, it’s a setup. The next few years will reward investors who stay patient, focused, and ready to acquire when others fold.

🧠 Owner Insight of the Month

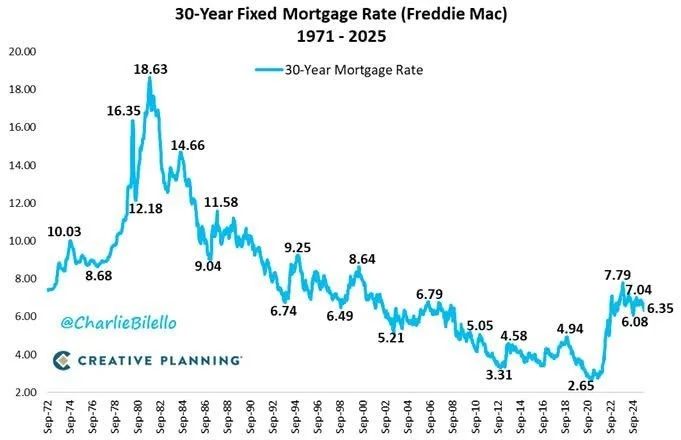

Think mortgage rates are high? Look back a few decades, they’re not.

Freddie Mac’s 50-year chart shows today’s rates sit almost exactly in the middle of the historical range. It feels high only because we got used to record lows between 2019 and 2021. In truth, today’s environment is balanced: rates are high enough to curb inflation but low enough to sustain solid property values.

Takeaway: Historically speaking, these rates are normal. Don’t count on refinancing at significantly lower levels anytime soon — instead, focus on deals that make sense today.

Final Thoughts

The Houston rental market is competitive, evolving, and full of both challenges and opportunities. Whether it’s keeping properties rent-ready, troubleshooting maintenance to save money, or holding through a rebalancing housing cycle, the fundamentals remain the same:

👉 Protect your cash flow, manage vacancies aggressively, and look for hidden value in your current portfolio.

👉 Want insights like this delivered straight to your inbox each month? Sign up for our free Houston Rental Market Newsletter.

Vacancy Kills Cash Flow. Here’s How We’re Fighting Back

Staying informed is the key to making smart investment decisions. This month, we’re looking at Houston rental market trends, Emerson portfolio performance, and practical strategies to protect cash flow and strengthen long-term returns.

📊 Portfolio Performance at a Glance

Rent Collection Rate: 93.4% (vs. 92.6% Houston average)

Eviction Rate: 1.2% (vs. ~9% Houston average)

Occupancy Rate: 88.7% (vs. 90.8% Houston average)

Rent collection continues to hold steady in the low-to-mid 90s. While this matches the broader market, our goal is always to exceed it. A key focus area right now is Houston’s new eviction laws, which are reshaping how quickly owners can remove non-paying tenants. We’ll provide a detailed breakdown of these changes later this year.

Evictions are up slightly compared to past years, though our rate (1.2%) is still dramatically below the Houston average of ~9%. We’ll be conducting a Q4 review of all evictions to refine policies and stay ahead of the legal curve.

Occupancy has ticked down since peaking at 95.7% in July, driven mostly by condos and small multifamily units in less desirable submarkets.

Takeaway: Focus on making your property stand out with great presentation and proper pricing. And if you’re not a client, review your eviction policies now to ensure compliance with the recent changes.

📈 Houston Market Snapshot

New Listings (HAR): 6,188 → 7,415 (+19.8% YoY)

Average Rent: $2,410 → $2,412 (+0.1% YoY)

Average Days on Market (DOM): HAR – 35 days | Emerson – 18 days (48.6% faster)

The trend is clear: more inventory, flat rents, and increased competition. With nearly 20% more listings than last year, tenants have more options and are becoming more selective.

At Emerson, our leasing speed is cutting through the noise with 18 days on market vs. 35 for Houston overall.

Investor insights:

More supply means tenants can afford to be picky. This is why we’re strict on Rent Ready Requirements!

Flat rents put cash flow under pressure, so reducing vacancy and controlling expenses is essential.

Leasing speed matters. Every extra day vacant costs money.

Remember: Vacancy kills cash flow.

🛠️ Maintenance Update

Median Speed of Repair: 3.7 days (vs. national average of 6–7 days)

Resident Satisfaction: 4.7/5.0

Work Orders Cancelled: 74.8%

We resolve maintenance requests in just 3.7 days, far ahead of the national average. Speed of repair is one of the strongest predictors of lease renewals, which is why we track it weekly.

Resident satisfaction has been consistently high this quarter, with a perfect 5.0/5.0 score nearly half the time!

The biggest surprise? Nearly 75% of work orders were cancelled. But instead of wasted effort, this actually saved owners money: most cancellations were pest control (tenant responsibility) or AC issues resolved in-house at no cost.

Takeaway: A knowledgeable management team that knows the tenant responsibilities, as well as how to troubleshoot, can save you thousands each year.

💬 Owner & Resident Satisfaction

Owner Retention Rate: 97.1%

Lease Renewal Rate: 69% (vs. ~55–65% national average)

Owner retention dipped slightly last month, though nearly 60% of offboards were initiated by us because the properties didn’t meet our standards. We’d rather grow intentionally than manage anything and everything.

Lease renewals fell from above 80% last month to 69% in August. After reviewing each case, every non-renewal was due to lifestyle changes, not performance.

Why it matters: Renewals are one of the strongest tools to protect cash flow. Each renewal saves on turnover costs, leasing fees, and vacancy time.

📸 Value-Add Spotlight

When it’s tough to buy new properties, look for opportunities in your current portfolio.

2023 Rent: $1,775/mo

2024 Rent: $1,895/mo

2025 Rent: $1,945/mo

That’s a 9.6% increase over two years, even as much of the market has seen rent compression. For this investor, it means an extra $170/month (or $2,040/year) in cash flow.

As my mom always said: when life gives you lemons, make lemonade. In today’s market, that means squeezing hidden value out of the properties you already own.

🧠 Owner Insight of the Month

Use caution when deciding whether to sell or when factoring appreciation into your next deal.

Across the South, home prices are seeing modest compression, while the Midwest shows growth. In Houston, one-third of listings have price cuts. That sounds alarming, but remember: the South saw the steepest gains since 2020. Today’s pullback looks more like a healthy rebalancing.

Some analysts believe this correction could last until 2030. Unless you’re forced to sell, holding for the next 2–5 years may be the smarter move.

Even with affordability near record lows, the fundamentals of rental real estate remain strong.

Final Thoughts

The Houston rental market is competitive, evolving, and full of both challenges and opportunities. Whether it’s keeping properties rent-ready, troubleshooting maintenance to save money, or holding through a rebalancing housing cycle, the fundamentals remain the same:

👉 Protect your cash flow, manage vacancies aggressively, and look for hidden value in your current portfolio.

👉 Want insights like this delivered straight to your inbox each month? Sign up for our free Houston Rental Market Newsletter.

Houston Rents Flat, Supply Rising - What This Means for You

The Houston rental market is shifting, and property owners need to understand both the risks and the opportunities. At Emerson Property Management, we track performance data and market trends closely so our clients can stay ahead. Here’s what’s happening in the market right now.

📊 Emerson Portfolio Performance at a Glance

Rent Collection Rate: 94.0% (vs. 95% national average)

Eviction Rate: 0.8% (vs. ~9% Houston average)

Occupancy Rate: 91.1% (slightly above Houston average)

Our rent collection continues to improve as we remove non-paying residents. While evictions are taking longer due to residents filing extensions or appeals, our overall eviction rate remains well below the market. Each case is reviewed as a risk-management exercise to ensure our screening standards remain effective.

Takeaway: Tenants are becoming more savvy at delaying evictions, which can increase lost income and risk. The best protection is strong upfront screening and being prepared for longer timelines if eviction becomes necessary.

📈 Houston Market Snapshot

New Listings (HAR): 5,764 → 7,869 (+36.5% YoY)

Average Rent: $2,430 → $2,424 (-0.2% YoY)

Average Days on Market: HAR – 34 days | Emerson – 31 days (8.8% faster)

Supply is climbing and rent growth is flat, but demand remains resilient. Houston continues to attract new residents and was recently ranked among the top U.S. cities where people want to live. Higher interest rates and affordability challenges are keeping many would-be buyers in the rental pool.

Builders are sustaining sales through aggressive financing incentives, but resale values are softening as price cuts hit their highest levels since the pandemic.

For long-term investors: This means strong rental demand, steady retention, and buying opportunities at better terms than we’ve seen in years.

For sellers and flippers: More competition, deeper concessions, and a higher likelihood of price cuts. If you can, waiting 2–3 years to sell may yield better results.

🛠️ Maintenance & Resident Satisfaction

Median Speed of Repair: 4.1 days (vs. national avg. 6–7 days)

Resident Satisfaction: 4.4/5.0

Lease Renewal Rate: 81.8% (vs. ~55–65% national average)

Fast repairs and proactive decisions are key to protecting properties while keeping residents satisfied. Last month, nearly 30% of work orders were resolved or appropriately declined — without sacrificing satisfaction.

Takeaway: Quick response times and smart repair decisions build resident trust, reduce turnover, and protect your bottom line.

📸 Value-Add Spotlight: Simple ROI Wins

Not every improvement requires a major renovation.

Example: 10918 Barker View Drive

Make-ready cost: $2,740 (HVAC service, rekey, code work, cleaning, touch-ups)

Result: Rent increased by $144/month = $1,728 more per year

ROI: 63% return on investment

Lesson: Small, cost-effective improvements can deliver outsized returns.

🧠 Owner Insight of the Month

Zillow confirms what we’ve long practiced: allowing pets reduces vacancy. Homes that allow pets lease an average of 8 days faster than those that don’t.

Tip: In today’s competitive market, pet-friendly policies are one of the simplest ways to keep properties occupied and cash flow steady.

✅ Final Takeaway for Owners

Rental demand in Houston remains strong, even as rents flatten.

Emerson continues to outperform the market in leasing speed, renewals, and resident satisfaction.

For long-term investors, this environment offers opportunities not seen in the past five years.

👉 Want insights like this delivered straight to your inbox each month? Sign up for our free Houston Rental Market Newsletter.

More Listings, More Competition — Are You Ready?

Stay ahead of the market with our June portfolio performance recap, covering key stats, market trends, resident satisfaction insights, and a spotlight on real returns from a strategic upgrade.

📊 Portfolio Performance at a Glance

Rent Collection: 92.9% (vs. 95% national average)

Eviction Rate: 0.39% (vs. ~9% Houston average)

Occupancy: 95.7% (vs. 90.8% Houston average)

We’re outperforming the market in occupancy and eviction prevention. Rent collection dipped slightly due to a few delayed payments that were resolved after eviction filings — a reminder to always follow through on your lease enforcement process.

📈 Houston Market Snapshot

New Listings: 7,117 (+12.7% YoY)

Average Rent: $2,400 (+0.97% YoY)

Average DOM: HAR – 35 days | Emerson – 22 days (37% faster)

The Houston market is shifting. Supply is climbing, and while rent and DOM have remained stable so far, we expect more pressure in the coming months. Tenants are increasingly selective, making property condition a critical differentiator.

Tip: Now’s the time to address deferred maintenance or minor updates. Clean, well-maintained properties are winning in today’s leasing environment.

🛠️ Maintenance Update

Median Speed of Repair: 2.2 days

Resident Satisfaction: 4.8 out of 5

Fast, professional maintenance is one of the most underrated drivers of tenant retention and long-term ROI. Our median repair time last month was just 2.2 days — faster than many in-house teams — with nearly perfect resident satisfaction.

💬 Owner & Resident Satisfaction

Owner Retention: 96.8%

Lease Renewal Rate: 57%

Some owners chose to exit underperforming assets — a strategic move given that 32.9% of listings in Houston had price drops, the highest in 5 years. On the resident side, most move-outs were tied to life events or property sales, not dissatisfaction. July renewals are already rebounding.

Tip: Always ask why a resident is moving. It helps you identify (or rule out) problems worth fixing.

📸 Value-Add Spotlight: 27.6% ROI From One Turnover

At 12322 Wild Pine Dr, we invested ~$16,254 in strategic upgrades (paint, LVP, fixtures, curb appeal). The result?

Rent increased from $975 → $1,349/month

Annual income increased by $4,488

ROI: 27.6%

Before buying your next property, look within your current portfolio — value may already be sitting there.

🧠 Owner Insight of the Month: Pest Prevention

Houston heat = pest activity. Roaches, ants, and rodents love vacant units, and even a short vacancy can lead to a major infestation.

Tip: Treat proactively and schedule a quick walkthrough after any extended vacancy. It could save you thousands in damage and lost rent.

And no — those aren’t chocolate sprinkles on the floor…

Need a pest control referral? We've got you covered.

👋 Want Insights Like This Sent Monthly?

If you’re not already working with us, you can still get these performance reports, market updates, and investment tips — for free.

👉 Join Our Monthly Newsletter and stay ahead of the Houston rental market.

To your success,

Cam

Founder, Emerson Property Management

Houston’s Expert in High-Performance Rentals

How Emerson Clients Are Beating the Houston Rental Market in 2025

At Emerson Property Management, we believe that performance speaks louder than promises. While many landlords are struggling to navigate a shifting rental landscape, our clients are consistently outperforming the market — in rent collection, occupancy, and return on investment.

Here’s a quick look at how our portfolio stacked up in May 2025 — plus a few insights you can apply to your own rentals.

📊 Portfolio Performance at a Glance

Rent Collection Rate: 96.2% (vs. 95% national average)

Eviction Rate: 0.77% (vs. ~9% Houston average)

Occupancy Rate: 93.5% (vs. 90.8% Houston average)

Strong collection rates and minimal evictions aren’t luck — they’re the result of proactive tenant screening, disciplined lease enforcement, and clear communication. Our team’s systems are built to keep cash flow consistent and your risk minimized.

📈 Houston Market Snapshot: Resilient, but Competitive

Despite a 17.1% year-over-year increase in new rental listings, Houston’s rental prices have held steady:

New Listings (HAR): 5,699 → 6,672

Average Rent: $2,348 → $2,349 (0% YoY growth)

Average Days on Market: HAR – 39 days | Emerson – 21 days (46.1% faster)

Even with rising inventory, tenants are renting quickly — but they’re getting more selective. We’re seeing slower movement in multifamily units, properties with deferred maintenance, and less desirable locations. If you’re considering your next investment, ask yourself: Would a quality tenant want to live here?

💡 Investment Spotlight: 35.2% ROI on One Turnover

One of our recent projects at 20614 Park Row Dr shows how targeted improvements can unlock serious value:

Upgrades: Full repaint, new carpets, fixtures, deep cleaning (~$11,000)

Result: Rented in 10 days at $323/month more than prior lease

Annual Income Boost: $3,876

Return on Turnover Investment: 35.2%

You don’t always need to buy another property to grow your returns.

Sometimes, the opportunity is already sitting in your portfolio — it just needs the right improvements.

🛠 Maintenance Update: Fast Repairs, Happy Tenants

Median Speed of Repair: 3.7 days

Resident Satisfaction: 4.7 out of 5

Quick maintenance isn’t just about avoiding complaints — it directly impacts tenant retention and asset preservation. National data shows maintenance issues are the #1 reason tenants leave, and in today’s supply-rich market, renters have more choices than ever.

🧠 Owner Insight: Don’t Skip HVAC Maintenance

HVAC breakdowns spike every July — and cost landlords $1,500–$2,500 on average. But a $75–$150 preventative tune-up can catch issues like low refrigerant or worn parts before they become emergencies.

At Emerson, we schedule HVAC maintenance proactively before renewals, so our owners avoid the stress (and cost) of peak-season failures. If your system is over 10 years old or acting up, now’s the time to act.

👋 Want Insights Like This Sent Monthly?

If you’re not already working with us, you can still get these performance reports, market updates, and investment tips — for free.

👉 Join Our Monthly Newsletter and stay ahead of the Houston rental market.

To you success,

Cam

Founder, Emerson Property Management

Houston’s Expert in High-Performance Rentals

April 2025 Houston Rental Market Update: Performance, Trends & Owner Insights

Welcome to your monthly owner update, where we break down Houston rental market trends, Emerson’s portfolio performance, and key ownership insights to help you maximize returns. Whether you're self-managing or fully hands-off, the data this month speaks volumes.

📊 Portfolio Performance at a Glance – April 2025

April came with a few surprises. Here’s how our managed portfolio stacked up:

Rent Collection Rate: 91.1% (vs National Average of 95%)

Eviction Rate: 0.87% (vs Houston Average of ~9%)

Occupancy Rate: 93.8% (vs Houston Average of 90.8%)

Insight: The dip in rent collection? It stemmed from several evictions — all tied to tenants not placed by Emerson.

In fact, 93.5% of all evictions we handled last year were for tenants placed by the owner or an outside agent. That stat alone should raise eyebrows.

Takeaway: Tenant screening isn’t a formality — it’s an investment safeguard. If you're handling placements yourself or relying on third-party agents, make sure their screening process is air-tight. A bad tenant doesn’t just cost you rent — they cost you peace of mind.

📈 Houston Market Snapshot – April 2025

The broader Houston market remains steady, with signs of modest cooling as new listings rise. Here’s the latest:

Average Rent (HAR): $2,288 → $2,330 (+1.8% YoY)

Average Days on Market: HAR - 41 days | Emerson - 8 days

(That’s 80.5% faster.)

Slower rent growth and increased time on market are signs of a shifting climate — but our team is still leasing at high velocity.

Why Our Properties Lease Faster:

Professional photography + detailed floor plans for every listing

Real-time pricing adjustments based on hyperlocal data

A dedicated Leasing Specialist focused solely on converting leads

Spring and early summer are peak leasing seasons, and we're making sure your property doesn’t miss a beat.

🛠️ Maintenance Performance – April 2025

Average Work Order Cost: $317.44

Median Speed of Repair: 4.5 days

Issues Resolved Without Sending a Vendor: 54 (Est. $17,141 saved for owners)

While a few HVAC replacements bumped up our average costs, we’re continuing to hit our repair targets and minimize expenses by:

Avoiding unnecessary cosmetic work

Holding tenants accountable

Solving problems before dispatching vendors

Bottom line: Less spend. Faster results. More ROI.

💬 Owner & Resident Satisfaction – April 2025

Owner Retention Rate: 99.4%

Resident Satisfaction: 4.7/5.0

Lease Renewal Rate: 75%

Performance continues to exceed industry standards across the board.

Renewals dipped slightly last month, but not due to dissatisfaction — just typical life transitions like job relocations and upsizing.

Reminder: Happy residents renew. Fewer turnovers = more consistency = higher returns.

🧠 Owner Insight of the Month: Hurricane Prep

Hurricane season starts June 1st — here’s your quick prep checklist:

Review insurance coverage

Trim overhanging tree limbs

Clear gutters and inspect drainage

Secure outdoor items and check sump pumps

As a client, know that our team assesses storm risk during every turnover. But proactive prep today can prevent major headaches tomorrow.

📣 Let’s Hear From You

Which part of this update did you find most valuable? Want more charts? Less data? A corny landlord joke at the end?

Let’s connect on LinkedIn — I’d love your feedback and ideas for future updates.

To your success,

Cam

Broker/Owner, Emerson Property Management