Why Flat Rents Could Be Great News for Savvy Landlords

The Houston rental market continues to level off, and while some numbers have softened, the fundamentals remain strong for disciplined owners. Below is a snapshot of what’s happening across our portfolio, and what it means for you as a property owner or investor.

📊 Total Portfolio Performance at a Glance

Rent Collection Rate: 89.4% (vs. 92.6% Houston average)

Eviction Rate: 1.6% (vs. ~9% Houston average)

Occupancy Rate: 93.1% (vs. 90.8% Houston average)

Rent collection dipped below 90% for the first time since we began tracking this data, largely due to a recent spike in evictions. In the past six months, we’ve had more evictions than in the previous twelve combined.

We’re currently reviewing changes to Texas eviction laws to identify ways to expedite the process and completing our annual analysis to update our screening criteria. On a brighter note, occupancy has rebounded from August thanks to strong lease-ups on new onboarded and previously challenging properties.

Takeaway: Even with strong qualifications, evictions can still happen. Screening reduces the odds — but never to zero. That’s why we offer our Eviction Guarantee to protect owners against unexpected losses. If your management company doesn’t offer one, ask why.

📈 Houston Market Snapshot

New Listings (HAR): 5,510 → 6,841 (+24.2% YoY)

Average Rent: $2,341 → $2,347 (Flat YoY)

Average Days on Market: HAR – 37 days | Emerson – 25 days (32.4% faster)

Inventory remains elevated and rents have stayed flat for most of the year, a clear sign that tenants now have more choices and more leverage.

That’s why we continue emphasizing our Rent Ready Requirements. Properties that are clean, well-maintained, and truly move-in ready lease faster and attract better tenants. In today’s high-supply market, presentation is everything.

Takeaway: In a crowded market, the best-presented homes win. Investing a little more upfront in condition and curb appeal leads to faster leasing and stronger residents. You only get one first impression, make it count.

🛠️ Maintenance Update

Median Speed of Repair: 3.9 days (vs. national avg. 6–7 days)

Resident Satisfaction: 4.5 / 5.0

Work Orders Cancelled: 25.6%

Our repair times continue to outperform industry averages, even against companies with in-house maintenance teams, which drives consistently high resident satisfaction.

About one in four work orders last month were cancelled because they were cosmetic or a resident responsibility. Striking the right balance between denying unnecessary requests and keeping residents satisfied is key to preventing turnover.

Takeaway: Fast repairs build trust, but setting clear expectations is just as important. The best operators fix what matters quickly and help residents understand what doesn’t.

💬 Owner & Resident Satisfaction

Owner Retention Rate: 97.2%

Lease Renewal Rate: 67% (vs. 55–65% national avg.)

Owner retention dipped slightly as a few owners chose to sell. If you’re considering the same, waiting until spring for stronger buyer activity, or ideally 2–4 years for inventory to normalize, may produce a better outcome.

Renewals remain above the national average but below our typical 75–80%. Most move-outs were due to lifestyle changes rather than property condition. Interestingly, two residents cited maintenance concerns despite having almost no service history, proof that perception and communication are just as important as actual performance.

Takeaway: In a flat rent market, renewals are your best ROI lever. Focus on resident experience, proactive communication, and small improvements that make tenants want to stay.

📸 Cautionary Spotlight: The Rent Growth Reality Check

When evaluating a rental property, most investors assume 3–5% annual rent growth, a rule of thumb that’s held true for years. But the market is shifting. Many new leases are now flat or slightly below prior rates:

$2,855 → $2,695

$2,040 → $1,875

$1,805 → $1,849

This isn’t cause for concern, it’s a natural reset after a decade of rapid appreciation. We expect rent growth to remain modest for the next couple of years before returning to historical averages.

The best investors see this as an opportunity. As “hobby landlords” panic and sell, disciplined owners who maintain standards and hold capital will be positioned to buy strong assets below market value.

Takeaway: Flat rent growth isn’t a threat, it’s a setup. The next few years will reward investors who stay patient, focused, and ready to acquire when others fold.

🧠 Owner Insight of the Month

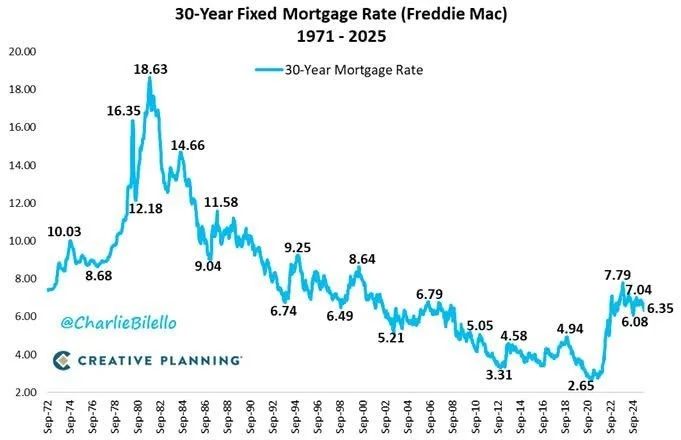

Think mortgage rates are high? Look back a few decades, they’re not.

Freddie Mac’s 50-year chart shows today’s rates sit almost exactly in the middle of the historical range. It feels high only because we got used to record lows between 2019 and 2021. In truth, today’s environment is balanced: rates are high enough to curb inflation but low enough to sustain solid property values.

Takeaway: Historically speaking, these rates are normal. Don’t count on refinancing at significantly lower levels anytime soon — instead, focus on deals that make sense today.

Final Thoughts

The Houston rental market is competitive, evolving, and full of both challenges and opportunities. Whether it’s keeping properties rent-ready, troubleshooting maintenance to save money, or holding through a rebalancing housing cycle, the fundamentals remain the same:

👉 Protect your cash flow, manage vacancies aggressively, and look for hidden value in your current portfolio.

👉 Want insights like this delivered straight to your inbox each month? Sign up for our free Houston Rental Market Newsletter.